Wall Street’s S&P 500 index has nearly erased all its post-election gains as rising bond yields and inflation fears weigh heavily on investor sentiment.

Markets are bracing for potential turbulence from President-elect Donald Trump’s incoming administration and its economic policies, including tax cuts, tariffs, and immigration reforms.

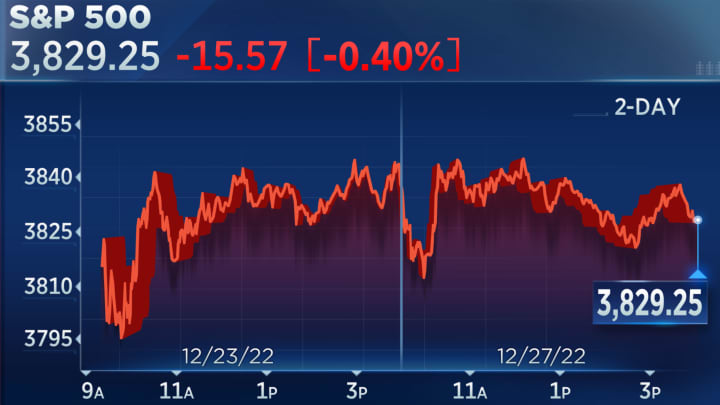

Market Overview

The S&P 500 ended the week down 2%, closing less than 1% above its levels on November 5, the day of the U.S. election.

Futures for the index dropped an additional 1% on Monday, with the VIX volatility index spiking above 22 for the first time in 2025—returning to levels seen on election day.

The sell-off was compounded by stronger-than-expected U.S. payroll data, which exceeded forecasts and pushed the unemployment rate lower.

While robust employment figures suggest economic strength, they have raised concerns about a potential resurgence of inflation, prompting speculation that the Federal Reserve might need to shift from rate cuts to tightening.

Bond Market Turmoil

Treasury yields continued their upward trajectory, with 10-year yields surpassing 4.8% on Monday—the highest level since late 2023 and a 115 basis-point surge since the Fed began easing in September.

Two-year yields also hit 4.4%, their highest since July, while the dollar index climbed to its strongest level since 2022.

The bond market’s unease reflects fears that the Fed’s rate-cutting cycle may be ending, with some analysts even suggesting the possibility of rate hikes in the near future.

Energy Prices and Sanctions

Crude oil prices surged to their highest levels since August, gaining 8% year-on-year—the largest increase since July. The rally was driven by new U.S. sanctions targeting Russian oil producers Gazprom Neft and Surgutneftegas, as well as 183 vessels linked to Russian oil exports.

These measures are expected to disrupt Russian crude supplies to major importers like China and India, potentially reshaping global oil trade routes and increasing costs.

Global Market Reactions

- Asia: Chinese and Hong Kong markets extended losses, with Hong Kong stocks logging a six-day losing streak. Despite improved December trade figures, analysts attribute the data to exporters front-loading shipments ahead of expected Trump-era tariffs.

- India: The Indian rupee suffered its largest single-day drop in two years, hitting a record low against the dollar.

- Europe: Rising U.S. yields pressured British gilts, with UK 30-year bond yields reaching a 27-year high. The pound fell to its lowest level since October 2023.

Upcoming Events

Key developments to watch in the coming days include:

- Inflation Data: December’s Consumer Price Index (CPI) report on Wednesday will provide critical insights into inflation trends.

- Corporate Earnings: Major U.S. banks, including JPMorgan, Citigroup, and Goldman Sachs, will kick off the earnings season on Wednesday.

- Tech Updates: Taiwan Semiconductor Manufacturing Co (TSMC) is expected to report a 58% jump in Q4 profits on Thursday, driven by AI-related chip demand.

- Geopolitical Developments: Defence ministers from NATO allies are meeting in Warsaw to discuss the Ukraine conflict, while NATO Secretary General Mark Rutte will address the European Parliament.

As the market anticipates Trump’s inauguration and key economic data releases, investors face a pivotal moment that could define the trajectory of 2025’s financial landscape.

Leave a Comment