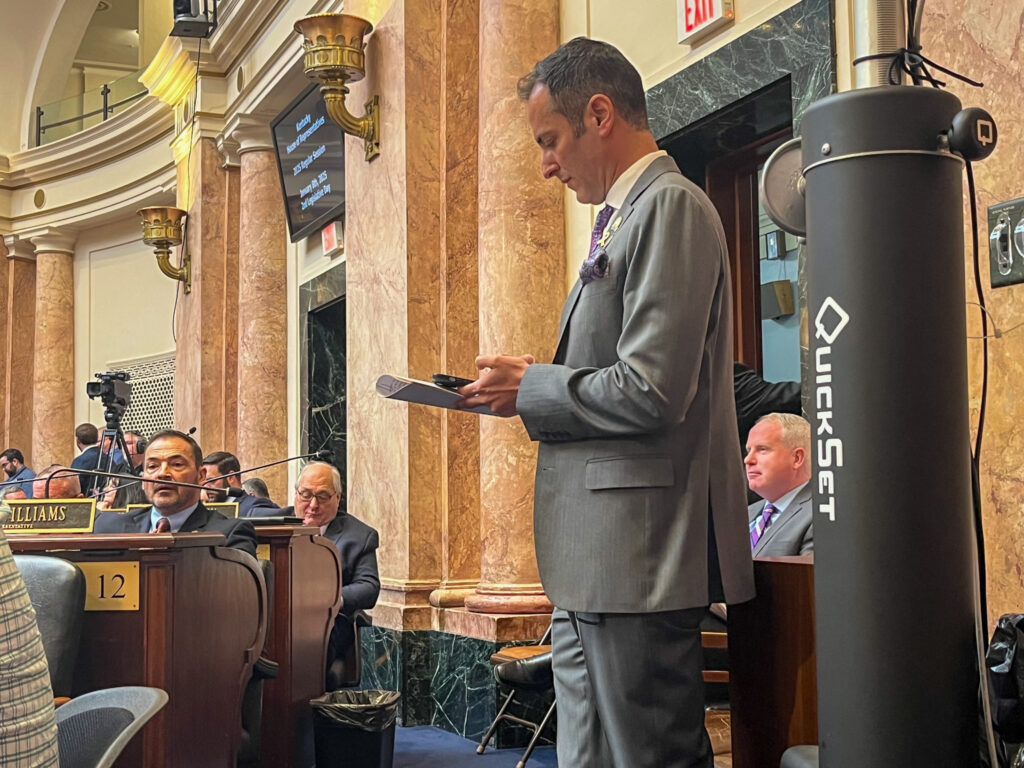

FRANKFORT, Ky. \u2014 The Kentucky General Assembly began its 2025 legislative session on Tuesday, even as Winter Storm Blair disrupted schools and businesses statewide.

With a 30-day session ahead, lawmakers are prioritizing income tax reduction, led by the Republican supermajority in both chambers.

This session does not include a biennial budget for approval. Lawmakers will meet for four days this week before adjourning until February.

The final day of the session is set for March 28, following a 10-day veto period when Governor Andy Beshear will review the bills passed.

House Republicans Make Income Tax Cuts Their Top Priority

Republicans hold significant majorities in the Kentucky House (80-20) and Senate (31-7). House Speaker David Osborne (R-Prospect) emphasized House Bill 1 (HB 1) as the top agenda item. The bill proposes reducing the state income tax rate from 4% to 3.5%.

HB 1 was filed Tuesday afternoon, with a committee hearing scheduled for Wednesday at 11:30 a.m.

Osborne expects the bill to pass through the House on Thursday and move to the Senate by Friday. The Senate is prepared to act swiftly, ensuring the bill progresses before lawmakers adjourn for a three-week break.

Osborne highlighted the GOP\u2019s broader agenda, quoting Majority Floor Leader Steven Rudy (R-Paducah), who described the session as \u201cone focused on lowering things\u201d\u2014from income tax to expectations on the number of bills passed.

Senate Ready for Swift Action

Senate President Robert Stivers (R-Manchester) confirmed that his chamber will work efficiently to process HB 1. \u201cWhen we return in February, it will be the first bill we address,\u201d Stivers stated.

The Senate plans to hold its first and second readings of the bill by the end of the week, ensuring readiness for committee review.

Governor Beshear has expressed his willingness to sign the bill, although he remains cautious about reducing the state income tax further.

The bill\u2019s passage appears inevitable due to the Republican majority, despite Democratic leaders seeking more time to review the proposal.

Background on the Tax Reduction Plan

The proposed tax cut follows a 2022 law that established a gradual reduction framework for Kentucky\u2019s income tax. The goal is to eventually eliminate the income tax entirely, provided specific economic conditions are met.

Osborne reaffirmed the GOP\u2019s commitment to this vision, noting that the current two-year budget approved in 2024 would see minimal changes.

Democratic Leaders Outline Their Priorities

House Democrats, led by new Minority Floor Leader Rep. Pamela Stevenson (D-Louisville), emphasized focusing on Kentucky\u2019s workforce, community safety, and infrastructure development.

Rep. Al Gentry (D-Louisville) and Rep. Lindsay Burke (D-Lexington) joined Stevenson in calling for stronger gun safety legislation, although such measures may face challenges in the Republican-dominated legislature.

Procedural Changes Spark Debate

Both chambers adopted new procedural rules for the session, allowing lawmakers to bypass debates in specific cases and limiting opportunities for vote explanations.

While Republicans unanimously supported these changes, Democrats expressed concerns about reduced public transparency and participation.

The General Assembly will reconvene on Wednesday at 2 p.m., followed by Governor Beshear\u2019s State of the Commonwealth address later that evening.

Our editorial team has thoroughly fact-checked this article to ensure its accuracy and eliminate any potential misinformation. We are dedicated to upholding the highest standards of integrity in our content.

Leave a Comment