A yearlong bipartisan investigation by the Senate has revealed how private equity-backed hospital systems in the U.S. are failing patients while their private equity owners continue to profit. The investigation found that private equity investors’ focus on profits has led to a decrease in the quality of care provided to patients in hospitals, especially in rural areas.

The inquiry centered on two major private equity firms, Apollo Global Management, which owns Lifepoint Healthcare, and Leonard Green & Partners, which previously owned hospitals under the Prospect Medical Holdings umbrella.

Apollo Global Management is known for owning Lifepoint Healthcare, which is the largest operator of rural hospitals in the country. On the other hand, Leonard Green’s Prospect Medical Holdings was involved with a network of hospitals from 2010 to 2021.

Over the last decade, private equity firms have spent over $1 trillion acquiring healthcare businesses, including hospitals, nursing homes, and physician practices. In their quest for profit, these firms often load the acquired businesses with debt and then attempt to cut costs to boost earnings.

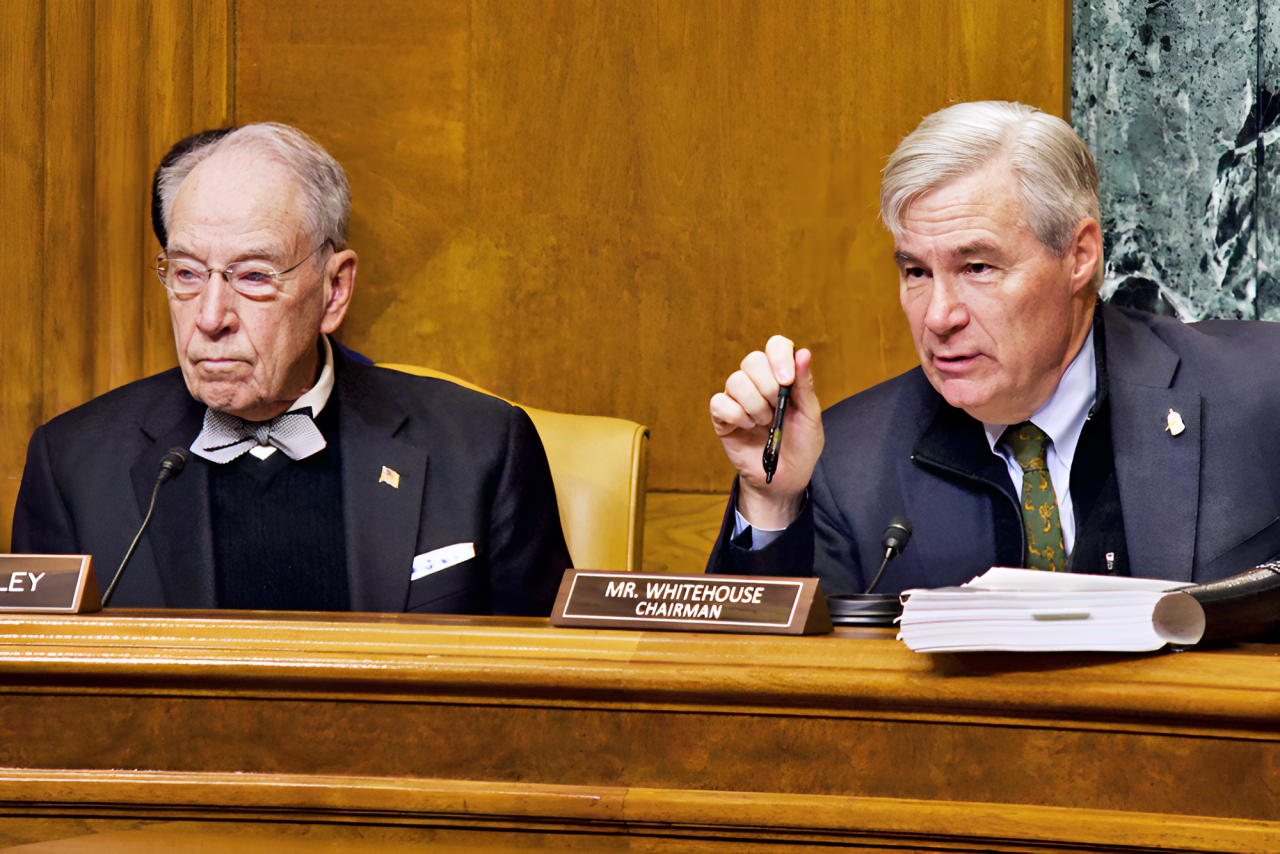

The Senate report, led by Senators Sheldon Whitehouse from Rhode Island and Chuck Grassley from Iowa, sought to uncover the financial impacts of private equity investments on hospitals and whether such practices were harming patients. What they found was deeply concerning.

The private equity-backed hospitals often faced chronic understaffing, violations of health and safety standards, and, in some cases, even hospital closures. At the same time, the private equity firms were reaping millions of dollars in profits.

Whitehouse and Grassley have been vocal about the findings, stating that private equity firms are putting their profits before patients’ needs. “As our investigation revealed, these financial entities are putting their profits over patients, leading to health and safety violations, chronic understaffing, and hospital closures,” he said in a statement. He emphasized that private equity investors pocketed millions of dollars while leaving local communities to suffer as hospitals faced financial ruin.

Academic studies have shown that when private equity firms invest in healthcare, patients often face higher costs. The care quality also decreases, with patients at private equity-owned hospitals experiencing more infections and falls, according to a 2023 study conducted by Harvard University and the University of Chicago.

This trend was further supported by the Senate’s findings, which showed that when Prospect Medical’s facilities improved financially, instead of reinvesting in the hospitals to improve patient care, the owners used the profits to pay themselves in the form of dividends.

The report revealed that Prospect Medical paid out a staggering $645 million in dividends to its investors, $424 million of which went to Leonard Green’s investors. Moreover, Prospect took out hundreds of millions of dollars in loans, which it later defaulted on, further worsening the hospital’s financial situation.

Apollo Global Management’s management of Lifepoint Healthcare also came under scrutiny. Investigators found that Lifepoint’s Ottumwa Regional Health Center in Iowa suffered from severe underinvestment, which led to a disturbing case where a male nurse sexually assaulted multiple incapacitated female patients.

Despite the failures in patient care, private equity firms like Apollo continued to collect millions of dollars from the hospitals. “A dependable health care system is essential to the vitality of a community,” Grassley commented. “This report is a step toward ensuring accountability so that hospitals’ financial structures can best serve patients’ medical needs.”

Prospect Medical Holdings responded to the report, calling it a misrepresentation of the facts. The company argued that many of the hospitals it acquired were in disrepair and facing closure before they stepped in to rescue them.

“Nearly all the hospitals Prospect acquired were cash-starved, neglected, in disrepair, and on the verge of closure or bankruptcy,” the company said. It claimed that it had invested more than $750 million in its hospitals and provided over $900 million in charity and uncompensated care.

Apollo, on the other hand, defended its involvement with Lifepoint Healthcare. A spokesperson for the company stated that Apollo’s funds had invested billions into Lifepoint, which helped improve facilities, expand local healthcare services, and recruit more care providers.

Apollo’s representatives pointed to third-party ratings, such as Leapfrog and CMS Star Ratings, which show that quality of care has improved at Lifepoint hospitals. They also claimed that despite challenges faced by rural hospitals, Lifepoint has managed to keep its facilities open and provide essential healthcare services in underserved areas.

However, the Senate report highlighted that the private equity firms’ priorities were not aligned with the best interests of the hospitals or the communities they served. One employee satisfaction survey from Ottumwa, cited in the report, expressed the frustration of staff who felt that the hospital was being treated as a number, not a healthcare institution.

After Prospect Medical installed a management audit committee to oversee its operations, there were indications that committee members felt pressured to stay silent about financial concerns.

In New Mexico, the attorney general launched an investigation into a Lifepoint-run facility after it was reported that Memorial Medical Center in Las Cruces had turned away cancer patients. While the hospital and Lifepoint denied the allegations, the controversy added to the growing concerns about private equity’s involvement in healthcare.

The investigation into private equity’s role in healthcare has underscored the negative impacts these firms can have on patient care and hospital operations. With private equity firms putting profits ahead of the well-being of patients, the public and lawmakers are calling for greater accountability in the healthcare sector. The Senate’s report highlights the need for reforms to ensure that healthcare providers prioritize patient care over financial gain.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates.

Leave a Comment